AMERICO RIVIEW

Overview of Americo

Americo Financial Life and Annuity Insurance Company, commonly known as Americo, is one of the largest independent, privately held insurance companies in the United States. Established in 1946, Americo offers a range of life insurance products, including final expense plans tailored to meet the needs of individuals seeking affordable and simple coverage for end-of-life expenses.

Headquarters Address:

300 W. 11th Street, Kansas City, MO 64105, USA

Official Website:

www.americo.com

Principles

Americo Financial Life and Annuity Insurance Company, a member of the Americo Life, Inc. family, has been dedicated to providing life insurance and annuity products for over a century. Their mission centers on delivering financial security and peace of mind to policyholders and their families.

While Americo does not explicitly list a set of core values, their commitment to customer satisfaction and financial stability is evident through:

- Customer-Centric Approach: Americo emphasizes understanding and addressing the unique needs of their clients, offering a range of products tailored to various financial situations.

Americo Final Expense - Financial Stability: As one of the largest independent, privately held insurance groups in the United States, Americo maintains a strong financial foundation, ensuring the reliability of their products and services.

Americo Final Expense - Innovation: The company continually seeks innovative solutions to meet the evolving needs of their clients, as demonstrated by their diverse product offerings and commitment to growth.

Americo Careers

Plans and Services Offered

Americo offers several final expense insurance plans designed to help cover end-of-life expenses, such as funeral costs and medical bills. These whole life insurance policies provide lifetime coverage with fixed premiums and build cash value over time.

Eagle Premier Series:

- Issue Ages: 40-85 for non-smokers; 40-80 for smokers.

- Face Amounts: $5,000 to $40,000.

- Death Benefit: Full death benefit available from day one.

- Features:

- Accelerated Benefit Payment Rider included at no additional cost, allowing for an advance payout if diagnosed with a terminal illness.

- Accidental Death Benefit Rider included at no additional cost, doubling the payout if death results from an accident.

- Child and Grandchild Term Rider available for an additional cost, providing coverage for eligible children and grandchildren.

- Quit Smoking Advantage: Smokers qualify for non-smoker rates for the first three policy years. If they quit smoking for at least 12 months before the third policy anniversary, they can maintain the non-smoker rates.

Eagle Guaranteed Series:

- Issue Ages: 50-80.

- Face Amounts: $5,000 to $10,000.

- Death Benefit: Graded death benefit for the first three years:

- Year 1: Return of premium plus 5%.

- Year 2: Return of premium plus 10%.

- Year 3: 75% of the face amount.

- Year 4 onward: 100% of the face amount.

- Features:

- Guaranteed issue with no medical underwriting; acceptance is guaranteed.

- Accidental Death Benefit included during the graded period at no additional cost.

Ultra Protector Series:

- Ultra Protector I & II:

- Issue Ages: 50-85.

- Face Amounts: $2,000 to $30,000.

- Death Benefit: Level death benefit from day one.

- Features:

- Simplified underwriting with no medical exams; eligibility determined by health questions.

- Optional Child and Grandchild Term Rider available for an additional cost.

- Ultra Protector III:

- Issue Ages: 50-80.

- Face Amounts: $2,000 to $10,000.

- Death Benefit: Graded death benefit for the first three years:

- Year 1: Return of premium plus 5%.

- Year 2: Return of premium plus 10%.

- Year 3: 75% of the face amount.

- Year 4 onward: 100% of the face amount.

- Features:

- Guaranteed issue with no health questions or medical exams.

- Accidental Death Benefit included during the graded period at no additional cost.

These plans are available in most states, with some variations based on state regulations. It’s advisable to consult with an Americo representative or licensed insurance agent to determine the best plan for your specific needs and to confirm availability in your area.

Key Features

- Simplified Underwriting: No medical exams required; eligibility is based on a health questionnaire.

- Guaranteed Level Premiums: Premiums remain the same throughout the policy duration.

- Fixed Death Benefits: Death benefits do not decrease over time.

- Flexible Payment Options: Monthly, quarterly, semi-annual, or annual premium payment modes.

- Cash Value Growth: Policies accrue cash value over time, which can be borrowed against if needed.

- Quit Smoking Advantage: A program designed to support smokers in their journey toward a healthier lifestyle while securing life insurance coverage. This initiative allows smokers to receive an Eagle Premier Smoker policy at nonsmoker rates for the first three policy years. If, before the third policy anniversary, you provide evidence of having quit all nicotine use for at least 12 months, your death benefit and premium will remain level. This approach not only makes life insurance more accessible to smokers but also encourages positive lifestyle changes, reflecting Americo’s commitment to customer well-being. For more detailed information, you can refer to Americo’s Quit Smoking Advantage FAQ.Additionally, Americo provides resources to assist in quitting smoking, such as counseling, medication options, and exercise recommendations, further demonstrating their dedication to supporting policyholders’ health goals.

Source: https://www.americo.com/Content/QuitSmokingAdvantage/ClientFAQ.pdf?utm

Sample Computation

For a 60-year-old non-smoking male purchasing a $10,000 policy under the Eagle Premier Level Benefit Plan:

- Monthly Premium: Approximately $45–$50

- Cash Value Accrual: Cash value starts building after the first policy year.

Age | Gender | Coverage Amount | Monthly Rates | Plan |

50 | Male | $10,000 | $45.00 | Level Benefit Whole Life |

50 | Female | $10,000 | $40.00 | Level Benefit Whole Life |

60 | Male | $15,000 | $78.00 | Level Benefit Whole Life |

60 | Female | $15,000 | $65.00 | Level Benefit Whole Life |

70 | Male | $20,000 | $135.00 | Level Benefit Whole Life |

70 | Female | $20,000 | $110.00 | Level Benefit Whole Life |

80 | Male | $25,000 | $245.00 | Guaranteed Issue Whole Life |

80 | Female | $25,000 | $215.00 | Guaranteed Issue Whole Life |

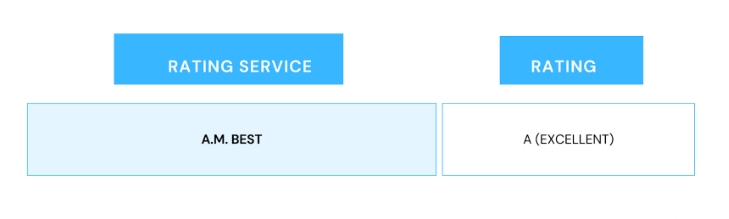

Financial Ratings

AM Best, a globally recognized credit rating agency, assigns financial strength ratings to insurance companies to indicate their ability to meet ongoing policyholder obligations. Americo Life, Inc. and its subsidiaries have consistently received strong ratings from AM Best, typically in the “A” range (Excellent). This rating reflects Americo’s solid financial position, consistent operating performance, and prudent risk management, demonstrating its reliability and stability in the insurance market.

Customer Reviews

PROS AND CONS

CUSTOMER REVIEWS

PROS

No medical exam is needed, making it simple and fast to apply.

Guaranteed approval options are available, even for people with health issues.

Flexible coverage amounts let you choose a plan that fits your needs and budget.

Some plans offer extra benefits, like accessing part of the payout early for serious illnesses.

Policies build cash value over time, which you can borrow if needed.

CONS

Some policies limit the payout during the first two years unless the death is accidental.

Policies may not be available in all states, so availability could be an issue.

Coverage is only for people aged 50-85, leaving younger applicants without options.

Guaranteed approval plans may have higher premiums than other options.

Borrowing from the policy's cash value comes with interest and reduces the payout.

What Sets Americo Apart?

- Trusted Experience

Americo has a rich history of providing dependable insurance solutions, earning the trust of customers for decades. Their longevity and expertise in the industry make them a reliable partner for your financial future.

- Customer-Centric Approach

Americo places people first. Their commitment to understanding customer needs and tailoring solutions sets them apart from competitors. They prioritize building lasting relationships over quick transactions.

- Innovative Products

Americo offers a diverse range of insurance and financial products designed to adapt to your unique goals. Their forward-thinking approach ensures policies that meet evolving customer needs.

- Financial Strength

With a solid financial foundation, Americo provides stability and confidence. Policyholders can trust that Americo will be there when they need it most.

- Simplified Processes

From straightforward application processes to user-friendly tools, Americo makes securing financial protection seamless and stress-free.

- Community-Focused Values

Americo is dedicated to giving back and supporting the communities it serves. This commitment to social responsibility reflects their broader mission of making a positive impact.

Who is Americo Final Expense Insurance For?

Americo Final Expense Insurance is designed for individuals seeking affordable, straightforward coverage to help their loved ones manage end-of-life expenses, such as funeral costs, medical bills, and other outstanding debts. This type of insurance is typically marketed to:

- Seniors or Older Adults

- Usually individuals aged 50–85 who want to ensure their family isn’t burdened with financial responsibilities after their passing.

- People with Limited Savings

- Those who may not have substantial savings or assets set aside for final expenses and want an affordable safety net.

- Individuals with Health Concerns

- Many final expense policies, including those from Americo, have lenient underwriting requirements. This makes them suitable for people who may not qualify for traditional life insurance due to health issues.

- Anyone Seeking Simplified or Guaranteed Coverage

- Americo offers simplified issue (no medical exam, only health questions) and guaranteed issue (no health questions or exam) policies, making it accessible for those who prefer quick and straightforward application processes.

- Families Looking for Peace of Mind

- Final expense insurance can provide reassurance to loved ones, ensuring they won’t need to scramble for funds during a challenging emotional time.

These policies are particularly helpful for those who need smaller coverage amounts, typically between $5,000 and $50,000, as they are specifically designed to cover end-of-life costs rather than larger financial obligations like mortgages or income replacement.

How to get Started?

Getting started with Americo Final Expense Insurance is simple:

- Research Your Options: Understand the different plans that Americo provides. Each plan offers unique features and benefits to accommodate various financial goals and requirements.

- Determine which one suits your financial goals and needs.

- Contact us: You can also reach out to us at MuleFinal to discuss your needs, clarify plan details, and complete the application over the phone at 213.318.2130.

- Prepare Necessary Information: Have your personal details ready, including your age, health history, and any information about tobacco use. This will help streamline the application process.

- Complete the Application: Fill out the simplified application form. No medical exam is required, but you’ll need to answer a few health-related questions for certain plans.

- Review Your Policy: Once approved, carefully review your policy details to ensure they meet your expectations. If any adjustments are needed, discuss them with your agent.

- Start Your Coverage: Pay your first premium to activate your policy. Enjoy peace of mind knowing your loved ones are financially protected.

For more information or to begin the process, contact MuleFinal, your trusted final expense broker.

How Does It Compare to Other Providers?

When comparing Americo Final Expense insurance to other providers like AIG, Mutual of Omaha, and Transamerica, it’s essential to look at key factors such as policy options, pricing, underwriting processes, and customer service. Here’s a detailed comparison:

Feature | Americo Final Expense | AIG Final Expense | Mutual of Omaha Final Expense | Transamerica Final Expense |

Policy Options | Americo offers immediate benefit, graded benefit, and modified benefit plans. | AIG offers similar plans: immediate, graded, and modified benefit. | Mutual of Omaha provides immediate benefit, graded, and modified options. | Transamerica also offers immediate benefit, graded, and modified options, with a focus on flexible payment terms. |

Coverage Amount | Coverage amounts range from $2,000 to $30,000 depending on the applicant’s age and health. | AIG offers coverage amounts ranging from $5,000 to $25,000. | Coverage amounts range from $2,000 to $50,000. | Transamerica offers coverage amounts ranging from $2,000 to $50,000. |

Underwriting | Simplified underwriting with no medical exams required. Some plans may ask a few health questions. | AIG offers simplified underwriting with no medical exams for most applicants. | Mutual of Omaha offers simplified underwriting, with a focus on accepting a wide range of health conditions. | Transamerica uses simplified underwriting for most applicants, with a health questionnaire rather than a medical exam. |

Premium Rates | Americo offers competitive premiums, especially for healthy applicants. | AIG’s premiums can be higher compared to Americo for those in good health. | Mutual of Omaha offers competitive premiums, often lower for those with certain health conditions. | Transamerica’s premiums are generally competitive, with some plans available for younger applicants. |

Living Benefits | Some Americo plans include accelerated death benefits for terminal illness at no extra cost. | AIG also offers accelerated death benefits for terminal illness at no additional charge. | Mutual of Omaha provides accelerated death benefits, with optional riders available. | Transamerica includes accelerated death benefits as a standard feature in many of its final expense policies. |

Age Eligibility | Typically accepts applicants aged 50–85, depending on the plan. | AIG accepts applicants aged 50–85, with some plans available up to age 89. | Mutual of Omaha accepts applicants aged 45–85, depending on the specific policy. | Transamerica accepts applicants aged 50–85, similar to Americo and AIG. |

Approval Time | Americo offers fast approvals, typically within 24–48 hours. | AIG’s approval process is similar, with decisions often made within 48 hours for most applicants. | Mutual of Omaha typically provides approval within 1-3 days, depending on the application. | Transamerica is known for its quick approval process, often within 24–48 hours. |

Policy Customization | Americo allows some flexibility in payment options and coverage amounts. | AIG offers several customization options, including premium payment schedules and benefit amounts. | Mutual of Omaha offers significant flexibility, especially in customizing policy riders and coverage amounts. | Transamerica also provides customization options, including flexible premium payment plans. |

Comparisons with Other Providers:

- AIG offers similar coverage and options, but premiums may be higher for healthy individuals. They also provide accelerated death benefits, similar to Americo.

- Mutual of Omaha may offer slightly more flexible coverage options, especially for applicants with health conditions, and often has lower premiums for these individuals.

- Transamerica stands out with its focus on flexible payment plans and competitive premiums, similar to Americo, but also offers coverage for younger applicants (as low as age 45 for some plans).

FINAL THOUGHTS

Americo Final Expense Insurance provides a reliable and affordable option for individuals looking to secure their loved ones from the financial burden of final expenses. With flexible coverage amounts, easy application processes, and a range of plans, Americo is a solid choice for those seeking peace of mind in their later years. Whether you’re looking for coverage with no medical exam or need a customizable plan, Americo offers accessible solutions tailored to various needs. Overall, their commitment to customer service and straightforward policies makes Americo a worthwhile consideration for anyone planning ahead.

Sources

Americo

Principles

https://americofinalexpense.com/PDFs/ClientBrochure.pdf?utm

https://www.americocareers.com/?utm

Plans and Services

https://www.americo.com/Content/ProductsAtAGlance.pdf?utm

Quit Smoking Advantage

https://www.americo.com/Content/QuitSmokingAdvantage/ClientFAQ.pdf?utm

Financial Ratings