AMERICAN AMICABLE REVIEW

Overview of American Amicable

American Amicable Life Insurance Company, founded in 1910 by W.W. Collier, is a well-established provider of life insurance and financial products. Headquartered in Waco, Texas, the company has built a strong reputation for delivering reliable coverage and financial security tailored to the diverse needs of individuals and families.

With over a century of experience, American Amicable is committed to customer satisfaction and financial strength. The company is part of the iA Financial Group, a leading financial institution, which enhances its ability to offer competitive products and exceptional service.

Product Offerings

American Amicable provides a wide range of insurance policies and supplemental products, including:

- Whole Life Insurance

- Term Life Insurance

- Final Expense Insurance

- Universal Life Insurance

- Retirement Solutions

These offerings are designed to be accessible, flexible, and affordable, ensuring peace of mind for policyholders.

Official Website: https://www.americanamicable.com/v3/about.php

Core Values and Legacy

Guided by principles of integrity, reliability, and innovation, American Amicable remains dedicated to safeguarding the financial futures of its customers. Its legacy of trust and dependability has made it a respected name in the life insurance industry.

As a trusted provider for over 100 years, American Amicable continues to uphold its mission of delivering high-quality insurance solutions and financial stability to its clients.

Plans and Services Offered

American Amicable offers a range of final expense insurance plans designed to help families manage end-of-life costs. These whole life insurance policies provide fixed premiums, guaranteed death benefits, and cash value accumulation. As of 2025, the primary plans include:

- Dignity Solutions

- Ages: 50 to 85 years

- Plan Options:

- Immediate Death Benefit: Pays 100% of the face amount immediately upon death.

- Graded Death Benefit: Pays 30% of the face amount if death occurs in the first year, 70% in the second year, and 100% thereafter.

- Return of Premium Benefit: Returns premiums paid plus 10% interest if death occurs within the first two or three years, depending on age; 100% paid after the graded period.

- Additional Features:

- Premiums guaranteed never to increase.

- Death benefits guaranteed never to decrease.

- Non-cancellable as long as premiums are paid.

- Guaranteed cash value accumulation.

- Benefits paid to beneficiaries are not subject to federal income tax.

- Family Legacy

- Ages: 0 to 49 years

- Plan Options:

- Immediate Death Benefit: Provides a level death benefit of 100% of the face amount paid immediately.

- Return of Premium Benefit: Returns premiums paid plus 10% interest for three years if under age 65, and for two years if age 65 or older; 100% paid after the graded period.

- Additional Features:

- Premiums guaranteed never to increase.

- Death benefits guaranteed never to decrease.

- Non-cancellable as long as premiums are paid.

- Guaranteed cash value accumulation.

- Benefits paid to beneficiaries are not subject to federal income tax.

- Golden Solution

- Ages: 50 to 85 years

- Plan Options:

- Immediate Death Benefit: Offers up to $50,000 in coverage for ages 50 to 75, and up to $25,000 for ages 76 to 85.

- Graded Death Benefit: Provides up to $25,000 in coverage for all ages, with benefits increasing over the first two years.

- Return of Premium Death Benefit: Returns premiums paid plus 10% interest if death occurs within the first two or three years, depending on age; 100% paid after the graded period.

- Additional Features:

- Premiums guaranteed never to increase.

- Death benefits guaranteed never to decrease.

- Non-cancellable as long as premiums are paid.

- Guaranteed cash value accumulation.

- Benefits paid to beneficiaries are not subject to federal income tax.

These plans are designed to provide financial security and peace of mind, ensuring that beneficiaries receive funds to cover final expenses without the burden of federal income tax.

Key Features

American Amicable offers Final Expense Insurance designed to provide financial security for end-of-life expenses. Here are the key features:

1. Policy Types

- Simplified Issue Whole Life Insurance: No medical exams required; approval based on answers to health questions.

- Guaranteed Issue Whole Life Insurance: No health questions asked; ideal for individuals with significant health issues.

2. Coverage Amounts

- Coverage typically ranges from $2,500 to $35,000, depending on the policy type and applicant’s age.

3. Fixed Premiums

- Premiums remain level for life and do not increase as the insured ages.

4. Cash Value Accumulation

- Policies build cash value over time, which can be accessed via loans or withdrawals if needed.

5. Accelerated Benefits

- Some plans offer accelerated death benefits for terminal illness or confinement to a nursing home.

6. Eligibility

- Available to individuals between the ages of 50 and 85, depending on the state and specific policy.

7. No Expiration

- Coverage lasts for the insured’s lifetime as long as premiums are paid.

8. Easy Application Process

- Streamlined application with quick approvals, especially for Simplified Issue policies.

9. Death Benefit

- Provides a guaranteed death benefit that is paid directly to the beneficiary to cover funeral costs, medical bills, or other expenses.

10. Flexible Payment Options

- Offers monthly, quarterly, semi-annual, or annual payment schedules to suit policyholders’ financial preferences.

11. Riders (Optional Add-Ons)

- Child/Grandchild Rider: Coverage for children or grandchildren.

- Accidental Death Benefit Rider: Additional payout in case of accidental death.

These features make American Amicable Final Expense policies a practical solution for individuals seeking to ensure their loved ones are not burdened by end-of-life expenses.

Sample Computation

Here’s a sample table for computing American Amicable Final Expense Insurance based on typical factors such as coverage amount, age, and monthly premiums. The values are illustrative and should be verified against actual rates.

Sample Computation of American Amicable Final Expense Insurance.The plan types typically include Immediate Death Benefit, Graded Death Benefit, and Modified Death Benefit.

Age | Gender | Coverage Amount | Plan Type | Monthly Premium |

50 | Female | $5,000 | Immediate Death Benefit | $14.00 |

50 | Female | $5,000 | Graded Death Benefit | $16.00 |

50 | Female | $5,000 | Modified Death Benefit | $18.50 |

50 | Male | $10,000 | Immediate Death Benefit | $31.65 |

50 | Male | $10,000 | Graded Death Benefit | $36.50 |

50 | Male | $10,000 | Modified Death Benefit | $42.00 |

60 | Female | $15,000 | Immediate Death Benefit | $54.00 |

60 | Female | $15,000 | Graded Death Benefit | $63.00 |

60 | Female | $15,000 | Modified Death Benefit | $74.00 |

60 | Male | $5,000 | Immediate Death Benefit | $24.00 |

60 | Male | $5,000 | Graded Death Benefit | $27.50 |

60 | Male | $5,000 | Modified Death Benefit | $32.00 |

70 | Female | $10,000 | Immediate Death Benefit | $58.00 |

70 | Female | $10,000 | Graded Death Benefit | $68.00 |

70 | Female | $10,000 | Modified Death Benefit | $78.00 |

70 | Male | $15,000 | Immediate Death Benefit | $104.00 |

70 | Male | $15,000 | Graded Death Benefit | $122.00 |

70 | Male | $15,000 | Modified Death Benefit | $135.00 |

Plan Type Details:

Immediate Death Benefit: Full benefit paid immediately upon death.

Graded Death Benefit: Partial benefit paid during the first 1-2 years, then full benefit thereafter.

Modified Death Benefit: Limited benefit during the first few years, often a return of premiums plus interest, with full benefit later.

Notes:

Rates vary by plan type, health conditions, and other underwriting factors.

These premiums are estimates; exact pricing will depend on individual assessments.

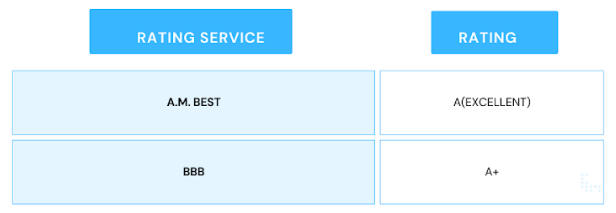

Financial Ratings

American Amicable Life Insurance Company has received strong financial ratings from reputable agencies, indicating its solid financial standing and reliability.

Sources

https://ratings.ambest.com/DisclosurePDF.aspx?AMBNum=9122

American-Amicable Life Insurance, established in 1910 and headquartered in Waco, Texas, has been recognized by Forbes in its 2025 list of America’s Best Insurance Companies.

This acknowledgment highlights the company’s commitment to providing reliable life insurance services.

Customer Reviews

American Amicable’s final expense insurance policies are designed to help individuals cover end-of-life expenses, such as funeral and burial costs, ensuring that these financial responsibilities do not fall upon their loved ones. The company offers whole life insurance plans with fixed premiums, accumulating cash value over time, and a simplified application process that typically does not require a medical exam.

PROS AND CONS

CUSTOMER REVIEWS

PROS

No medical exams are needed to apply.

Premiums stay the same forever.

Strong financial rating (A from A.M.Best)

Offers benefits for serious illnesses

CONS

Some delays in getting the policy.

Customer service can be slow.

Not available in all states.

Graded and Return of Premium Plans: These plans have limited benefits during the initial years, which may be a drawback for some applicants.

Overall, American Amicable’s final expense insurance provides a straightforward and reliable option for those seeking to manage end-of-life expenses. While the simplified application process and fixed premiums are significant advantages, potential applicants should be aware of possible delays in policy delivery and assess the availability of policies in their state. It’s advisable to consult with an insurance agent to determine the best plan suited to individual needs and circumstances.

What Sets American Amicable Apart?

American Amicable stands out in the life insurance industry due to its unique features and customer-focused offerings. Here are some key aspects that set American Amicable apart:

1. Simplified Issue Products

- American Amicable specializes in simplified issue life insurance policies, meaning no medical exams are required, and approval is often quicker than traditional policies. This makes their offerings accessible to a wider range of customers, including those with pre-existing health conditions.

2. Flexible Coverage Options

- They offer a range of insurance products, including term life, whole life, and final expense insurance. These products come with various riders and customization options to suit individual needs and budgets.

3. Living Benefits

- Many of their policies include living benefits, allowing policyholders to access a portion of their death benefit in cases of terminal, chronic, or critical illness. This feature provides added financial security during challenging times.

4. Competitive Pricing

- American Amicable provides affordable premiums, making life insurance coverage attainable for individuals and families on a budget.

5. Senior Market Focus

- They cater to the senior market with final expense plans and guaranteed issue policies. These products are designed to provide peace of mind for seniors seeking coverage without the barriers of health screenings or complicated underwriting.

6. Financial Strength

- Backed by strong financial ratings, American Amicable demonstrates stability and reliability, ensuring that policyholders can trust the company to honor its commitments.

7. Customer-Oriented Service

- Known for its efficient claims process and responsive customer support, American Amicable prioritizes customer satisfaction. Their streamlined processes reduce stress for policyholders and beneficiaries alike.

8. Support for Independent Agents

- American Amicable works closely with independent agents, offering comprehensive training and support. This ensures that clients receive personalized service and tailored policy recommendations.

By focusing on accessibility, flexibility, and customer-centric services, American Amicable distinguishes itself as a trusted and innovative provider in the life insurance market.

Who is American Amicable Final Expense Insurance For?

American Amicable Final Expense Insurance is designed for individuals looking to ease the financial burden on their loved ones by covering end-of-life expenses, such as funeral costs, medical bills, and outstanding debts. It is especially suited for:

- Seniors aged 50-85 seeking affordable lifetime coverage.

- Individuals with health issues who may not qualify for traditional life insurance.

- People on fixed incomes looking for budget-friendly premiums.

- Anyone wanting quick and easy approval with no medical exams or extensive paperwork.

This plan ensures peace of mind by providing financial security for final expenses.

HOW TO GET STARTED

Getting started with American Amicable Final Expense Insurance is simple:

- Research Your Options: Understand the different plans that American Amicable provides. Each plan offers unique features and benefits to accommodate various financial goals and requirements.

- Determine which one suits your financial goals and needs.

- Contact us: You can also reach out to us at MuleFinal to discuss your needs, clarify plan details, and complete the application over the phone at 213.318.2130.

- Prepare Necessary Information: Have your personal details ready, including your age, health history, and any information about tobacco use. This will help streamline the application process.

- Complete the Application: Fill out the simplified application form. No medical exam is required, but you’ll need to answer a few health-related questions for certain plans.

- Review Your Policy: Once approved, carefully review your policy details to ensure they meet your expectations. If any adjustments are needed, discuss them with your agent.

- Start Your Coverage: Pay your first premium to activate your policy. Enjoy peace of mind knowing your loved ones are financially protected.

For more information or to begin the process, contact MuleFinal, your trusted final expense broker.

How Does It Compare to Other Providers?

When comparing American Amicable‘s final expense insurance to other providers, it’s essential to consider the key factors that affect cost, coverage, eligibility, and unique benefits. Here’s a breakdown:

1. Plan Options

- American Amicable offers Simplified Issue Whole Life Insurance, which typically provides:

- Level Benefit Plan: Immediate full death benefit coverage.

- Graded or Modified Benefit Plan: Lower benefits during the first two or three years.

- Riders: Such as accelerated benefits for terminal illness.

- Comparison: Other providers like Aflac and AIG offer similar plans, but AIG often specializes in Guaranteed Issue policies with no health questions, whereas American Amicable emphasizes simplified underwriting.

2. Underwriting

- American Amicable employs simplified underwriting, which means fewer health-related questions and no medical exams, making it accessible to a wide range of applicants.

- Comparison:

- Providers like Mutual of Omaha and Foresters Financial offer similar simplified processes but may have stricter age or health requirements.

- AIG caters more to high-risk applicants with guaranteed issue policies, suitable for those with severe health conditions.

3. Coverage Amounts

- Coverage from American Amicable typically ranges from $2,500 to $35,000. This is sufficient for final expenses like funeral costs, medical bills, or debt repayment.

- Comparison: Some competitors, like Mutual of Omaha, may offer higher coverage limits (up to $40,000). However, higher amounts may not be necessary for basic final expense planning.

4. Premium Rates

- American Amicable provides competitive rates, especially for healthy individuals who qualify for level benefit plans.

- Comparison:

- Companies like Aetna Accendo may offer slightly lower premiums for smokers or those with certain health conditions.

- Colonial Penn, while affordable, often has limited payouts and “graded benefit” periods that delay full benefits.

5. Additional Features

- American Amicable often includes value-added benefits such as:

- Terminal illness riders.

- Accidental death benefits.

- Optional child or grandchild riders.

- Comparison:

- Competitors like Transamerica and Foresters Financial provide similar riders but may have more restrictive qualifications for additional benefits.

6. Reputation and Customer Support

- American Amicable has a solid reputation for quick claim payouts and responsive customer service.

- Comparison:

- Aflac and Mutual of Omaha are also known for customer-friendly service, while smaller or less-established companies may lack this consistency.

7. Financial Strength

- American Amicable is financially stable, with a strong rating from major agencies, ensuring reliability in paying claims.

- Comparison: Most top providers, such as AIG and Mutual of Omaha, also maintain excellent financial strength, providing similar assurance.

American Amicable is a strong contender in the final expense insurance market, especially for individuals seeking:

- Simplified underwriting.

- Competitive rates.

- Moderate coverage with added flexibility through riders.

However, for individuals with significant health concerns or those seeking guaranteed issue plans, AIG or Gerber Life may be better options. Conversely, those looking for higher coverage limits or lower smoker rates might benefit from exploring Mutual of Omaha or Aetna Accendo.

FINAL THOUGHTS

American Amicable’s Final Expense Insurance plans are a strong option for individuals seeking to secure their financial legacy and provide peace of mind for their loved ones. With a range of policy options, including simplified issue and guaranteed issue plans, American Amicable ensures that coverage is accessible to a variety of applicants, regardless of health status.

The plans offer competitive pricing, making them affordable for different budgets. Flexible coverage options are available to address funeral costs, medical bills, or other end-of-life expenses. The application process is streamlined, often requiring no medical exams for approval. Additionally, many policies build cash value over time, providing an extra financial safety net.

American Amicable’s reputation for reliability, customer service, and financial strength adds to the confidence that policyholders can have in their decision. However, as with any financial product, it’s essential to carefully review policy terms and conditions to ensure alignment with personal needs and goals.

When planning for final expenses, American Amicable is a reputable choice for providing stability, support, and peace of mind during challenging times.

SOURCES

American Amicable

https://www.americanamicable.com/v3/about.php

AM Best

https://ratings.ambest.com/DisclosurePDF.aspx?AMBNum=9122

American Amicable Plans

https://www.americanamicable.com/internet/webforms/aa/aa9504.pdf?utm_source

BBB

Financial Rating

https://www.americanamicable.com/v3/about.php

https://www.americanamicable.com/internet/POS/products/DSFL.htm