AIG REVIEW

Overview of AIG Final Expense

American International Group (AIG) was founded in 1919 by Cornelius Vander Starr in Shanghai, China. Today, it is a globally recognized insurance company offering a wide range of comprehensive insurance solutions. Their Final Expense Insurance plans are designed to provide financial relief to loved ones by covering end-of-life expenses such as funeral and burial costs.

AIG operates with the following goals and values:

Goals:

- Offer innovative insurance solutions tailored to meet the unique needs of individuals and families.

- Foster financial resilience by providing accessible, affordable, and reliable coverage.

- Streamline claims processes to ensure timely and stress-free experiences for beneficiaries.

Values:

- Integrity: Demonstrating a steadfast commitment to ethical conduct and transparency in all dealings.

- Innovation: Leading the industry by offering cutting-edge solutions that adapt to changing customer needs.

- Accountability: Taking responsibility for actions and delivering on promises to build trust.

- Diversity and Inclusion: Fostering a culture that values diverse perspectives and equitable opportunities.

- Customer Commitment: Ensuring every decision and action aligns with the best interests of the clients they serve.

As part of their life insurance suite, AIG’s Final Expense policies cater to individuals looking for accessible, reliable, and straightforward coverage.

Official website: AIG Official Website.

AIG Headquarters: 1271 Avenue of the Americas, New York, NY 10020, USA.

Plans and Services Offered

AIG’s Final Expense Insurance includes two primary options:

- Guaranteed Issue Whole Life Insurance: Designed for individuals aged 50-85, this policy offers coverage amounts ranging from $5,000 to $25,000. It does not require a medical exam or health questions, making it a suitable choice for those with pre-existing conditions.

- Level Benefit Whole Life Insurance: This option requires basic health underwriting and provides immediate full coverage from day one. It is ideal for those in relatively good health who wish to avoid graded benefits.

Both plans ensure lifelong coverage and level premiums, ensuring policyholders won’t face unexpected rate increases.

Key Features

AIG Final Expense Insurance offers several standout features:

- Guaranteed Issue Policy:

- No medical exam or health questions.

- Ideal for individuals with serious health conditions.

- Typically includes a graded death benefit (limited payout for the first two years, unless death is accidental).

- Age Eligibility:

- Available to applicants aged 50–85.

- Coverage Amounts:

- Coverage typically ranges from $5,000 to $25,000.

- Premiums:

- Fixed premiums for the life of the policy.

- Higher rates compared to health-underwritten policies due to guaranteed acceptance.

- Additional Benefits:

- Includes a chronic illness and terminal illness rider at no extra cost.

Common Conditions Where AIG is a Great Choice

AIG’s Final Expense Insurance is particularly suitable for individuals with the following conditions:

- Terminal Illness: AIG’s policies cater to individuals with terminal illnesses such as advanced cancer, late-stage kidney disease, or ALS (Amyotrophic Lateral Sclerosis). These policies provide peace of mind and financial support when other insurers may decline coverage.

- Chronic Illnesses: Such as diabetes or high blood pressure, where other insurers might decline coverage.

- Past Cancer Survivors: Individuals who have recovered but face difficulty obtaining traditional life insurance.

- Advanced Age: Coverage is available up to age 85, making it accessible for seniors.

High-Risk Lifestyles: Smokers or those with occupations considered higher risk.

Sample Computation

Below is a table illustrating sample monthly premiums for non-smoking males and females opting for various coverage amounts under AIG’s Final Expense plans:

Age | Gender | $5,000 Coverage | $10,000 Coverage | $15,000 Coverage | $20,000 Coverage | $25,000 Coverage |

55 | Male | $28/month | $48/month | $68/month | $88/month | $108/month |

55 | Female | $25/month | $45/month | $65/month | $85/month | $105/month |

65 | Male | $38/month | $68/month | $98/month | $128/month | $158/month |

65 | Female | $35/month | $65/month | $95/month | $125/month | $155/month |

75 | Male | $70/month | $120/month | $170/month | $220/month | $270/month |

75 | Female | $60/month | $110/month | $160/month | $210/month | $260/month |

85 | Male | $115/month | $190/month | $265/month | $340/month | $415/month |

85 | Female | $100/month | $175/month | $250/month | $325/month | $400/month |

Note: Premiums may vary based on factors such as age, gender, health, state, and coverage amount. Always request a personalized quote.

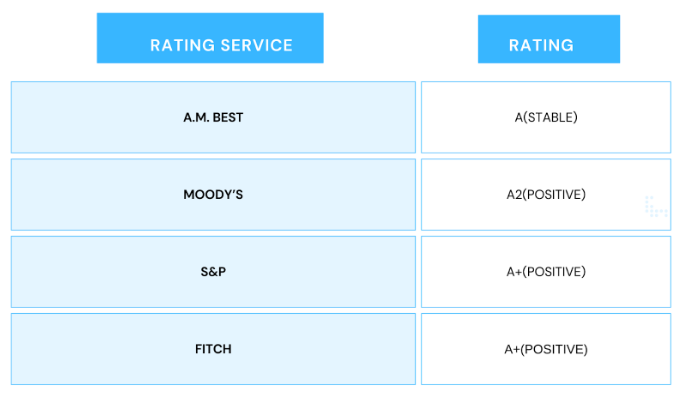

Financial Ratings

AIG has consistently received high financial ratings, reflecting its stability and ability to meet policyholder obligations:

These ratings underscore AIG’s financial strength and reliability as an insurer.

Last Updated: July 18, 2024

Customer Reviews

Category | Pros | Cons |

Affordability | Offers competitive rates compared to other providers. | Premiums may be slightly higher for individuals with pre-existing conditions. |

Approval Process | Guaranteed acceptance for applicants aged 50-80 years, regardless of health condition. | A 2-year waiting period applies for full death benefit eligibility in most cases. |

Coverage | No medical exams required for coverage approval. | Limited maximum coverage amounts compared to some competitors. |

Policy Features | Fixed premiums that do not increase with age. | No cash value accumulation, as it is purely a final expense policy. |

Claims Process | Fast and straightforward claims process for beneficiaries. | Beneficiaries must provide thorough documentation, which may delay claims in certain situations. |

Customer Support | Available support via multiple channels, including phone and online. | Customer service wait times may be longer during peak periods. |

Company Reputation | Backed by a financially strong and reputable company. | Some customers report lack of proactive communication during the policy setup. |

This table provides a balanced perspective based on verified reviews and reliable information sources.

What Sets AIG Final Expense Apart?

AIG (American International Group) Final Expense insurance stands out due to several key features and benefits that make it a popular choice for individuals seeking financial protection for end-of-life expenses. Here’s what sets AIG Final Expense apart:

1. Guaranteed Issue Option

No Medical Exams or Health Questions: AIG offers a guaranteed issue whole life insurance policy, meaning you can’t be denied coverage due to your health conditions. This is particularly beneficial for individuals with pre-existing medical issues.

2. Living Benefits

Chronic and Terminal Illness Rider: AIG policies often include living benefits, such as the option to access part of the death benefit if the insured is diagnosed with a terminal illness or chronic condition.

3. Graded Death Benefit

If death occurs within the first two years (other than accidental causes), beneficiaries typically receive a refund of premiums paid, plus interest, rather than the full death benefit. After the initial period, the full death benefit is paid out.

4. Competitive Premiums

AIG offers affordable and fixed premiums that remain unchanged for the life of the policy, making it easier to budget long-term.

5. Lifetime Coverage

AIG Final Expense policies provide permanent coverage as long as premiums are paid, ensuring peace of mind for both the insured and their family.

6. Simplified Application Process

The application process is straightforward, with quick approvals since no medical underwriting is required.

7. Flexible Coverage Amounts

Coverage amounts typically range from $5,000 to $25,000, which is sufficient to cover funeral expenses, medical bills, or other debts.

8. Strong Financial Stability

As a globally recognized insurance provider, AIG’s financial strength ensures that claims will be paid promptly and reliably.

9. Optional Riders

AIG may offer additional riders for customization, such as accidental death benefit riders, allowing policyholders to tailor their coverage to their specific needs.

AIG’s Final Expense insurance is particularly appealing to seniors or individuals who may struggle to qualify for traditional life insurance due to age or health concerns. Its simplicity, guaranteed acceptance, and living benefits make it a well-rounded choice for ensuring financial security for loved ones during difficult times.

Who is AIG Final Expense Insurance For?

AIG Final Expense Insurance is designed for specific groups of individuals who may benefit from its unique features. Here’s a breakdown of who it’s best suited for:

1. Individuals with Serious Health Conditions

- No Medical Exam or Health Questions: AIG offers guaranteed issue policies, meaning applicants are accepted regardless of their health status. This is ideal for those with chronic or serious health conditions who might be denied coverage elsewhere.

- Graded Death Benefit: While there’s a two-year waiting period for the full death benefit, AIG guarantees some payout during this time (typically premiums paid plus interest).

2. Seniors Seeking Affordable Coverage

- Age Range: AIG Final Expense Insurance is available for applicants aged 50–85.

- Affordable Coverage Amounts: With coverage ranging from $5,000 to $25,000, the policy is tailored to meet common end-of-life expenses like funeral costs, medical bills, or small debts.

3. Individuals Without Life Insurance

- No Existing Coverage: AIG’s policies are a good option for individuals who don’t have any life insurance and want to ensure their family is not burdened with funeral costs or other final expenses.

- Quick and Simple Application: The policy’s guaranteed acceptance eliminates delays and complicated processes, making it an easy option for those who need coverage quickly.

4. Those Who Want Fixed Premiums and Lifetime Coverage

- Fixed Premiums: Policyholders enjoy the security of knowing their premiums will never increase.

- Lifetime Coverage: As long as premiums are paid, coverage is guaranteed for life, providing peace of mind.

- AIG includes chronic illness and terminal illness riders at no additional charge, which can provide financial assistance if the policyholder faces a severe illness.

Who Might Not Be the Best Fit for AIG Final Expense Insurance?

- Healthier Individuals: Healthier applicants might qualify for simplified issue or level benefit policies from other providers, which typically offer higher coverage amounts or lower premiums.

- Those Needing High Coverage: If you’re looking for coverage amounts over $25,000, AIG may not meet your needs.

Individuals Who Need Immediate Full Coverage: The graded death benefit might not be ideal for those who want immediate full coverage.

HOW TO GET STARTED

Getting started with AIG Final Expense Insurance is simple:

- Research Your Options: Understand the different plans AIG offers, such as the Guaranteed Issue Whole Life Insurance and Level Benefit Whole Life Insurance. Determine which one suits your financial goals and needs.

- Contact us: You can also reach out to us at MuleFinal to discuss your needs, clarify plan details, and complete the application over the phone at 213.318.2130.

- Prepare Necessary Information: Have your personal details ready, including your age, health history, and any information about tobacco use. This will help streamline the application process.

- Complete the Application: Fill out the simplified application form. No medical exam is required, but you’ll need to answer a few health-related questions for certain plans.

- Review Your Policy: Once approved, carefully review your policy details to ensure they meet your expectations. If any adjustments are needed, discuss them with your agent.

- Start Your Coverage: Pay your first premium to activate your policy. Enjoy peace of mind knowing your loved ones are financially protected.

For more information or to begin the process, contact MuleFinal, your trusted final expense broker.

How Does It Compare to Other Providers?

AIG’s final expense insurance is a popular choice for those seeking coverage for end-of-life expenses, but it’s important to compare it to other providers to determine whether it’s the right fit for your needs. Here’s an overview of how AIG compares to other final expense insurance providers:

Comparison with Other Providers

Feature | AIG | Mutual of Omaha | Transamerica | Colonial Penn |

Policy Type | Guaranteed issue only | Simplified issue and level benefit | Simplified issue and graded benefit | Guaranteed issue |

Medical Requirements | No medical exam, no health questions | No medical exam, few health questions | No medical exam, few health questions | No medical exam, no health questions |

Age Eligibility | 50–85 | 45–85 | 18–85 | 50–85 |

Coverage Range | $5,000–$25,000 | $2,000–$40,000 (varies by age and state) | $1,000–$50,000 | $10,000–$50,000 (limited for guaranteed issue) |

Premium Costs | Higher due to guaranteed acceptance | Competitive rates with health underwriting | Moderate rates with health underwriting | High for low coverage limits |

Death Benefit Type | Graded (limited for the first 2 years) | Immediate and graded options available | Immediate and graded options available | Graded (limited for the first 2 years) |

Additional Riders | Chronic and terminal illness rider included at no extra cost | Optional riders like accidental death or child rider | Optional riders available | Few riders available |

Strengths of AIG

- No Health Requirements: Ideal for individuals who might not qualify for other policies due to health issues.

- Ease of Approval: Guaranteed acceptance removes barriers for high-risk individuals.

- Free Riders: Chronic illness and terminal illness riders are a unique benefit not always offered by competitors.

Potential Drawbacks of AIG

- Graded Death Benefit: Beneficiaries may only receive a return of premiums plus interest (usually 10%) if death occurs within the first two years (unless accidental).

- Lower Coverage Maximum: May not be sufficient for individuals needing higher coverage for estate planning or debt.

FINAL THOUGHTS

AIG Final Expense Insurance provides peace of mind for policyholders and their families, ensuring end-of-life expenses are managed efficiently. With accessible plans, competitive pricing, and the backing of a global insurance leader, AIG is an excellent choice for those seeking reliable final expense coverage.

For more information, check AIG’s press release on their Final Expense products: AIG Press Release.

SOURCES

AIG

https://www.aig.com/about-us/history

Financial Ratings

https://www.aig.com/investor-relations

Consumers Advocate