AFLAC REVIEW

Overview of Aflac

Aflac, established in 1955 by John Amos and Paul Amos, is a leading supplemental insurance provider in the United States. Aflac is headquartered in Columbus, Georgia. While best known for its workplace insurance products, Aflac has expanded its portfolio to include final expense insurance, catering to individuals seeking affordable and reliable coverage for end-of-life expenses. Aflac’s commitment to financial security and customer satisfaction has solidified its reputation as a trusted insurer.

Goals:

- To provide financial security and peace of mind to policyholders.

- To maintain a strong financial foundation, ensuring reliability and trustworthiness.

Values:

- To deliver exceptional customer service with transparency and efficiency.

- To innovate and adapt to changing customer needs in the insurance landscape.

- To provide financial security and peace of mind to policyholders.

- To deliver exceptional customer service with transparency and efficiency.

- To maintain a strong financial foundation, ensuring reliability and trustworthiness.

- To innovate and adapt to changing customer needs in the insurance landscape.

Official Website: www.aflac.com

Aflac’s corporate headquarters: 1932 Wynnton Road, Columbus, Georgia, 31999, USA

Plans and Services Offered

Aflac offers Final Expense Whole Life Insurance designed to help cover end-of-life expenses such as funeral costs, medical bills, and other related expenses. This insurance provides a guaranteed death benefit and fixed premiums that do not increase over time.

Plan Options:

- Level Plan:

- Death Benefit: Provides the full face value from the policy’s inception for both accidental and natural causes of death.

- Benefit Amounts:

- Ages 45-55: $5,000 to $50,000

- Ages 56-65: $5,000 to $40,000

- Ages 66-75: $5,000 to $30,000

- Ages 76-80: $5,000 to $20,000

- Additional Riders Available:

- Accelerated Death Benefit Rider: Allows access to a portion of the death benefit if diagnosed with a terminal illness.

- Accidental Death Benefit Rider: Provides an additional benefit if death results from an accident.

- Children’s Term Insurance Rider: Offers term life coverage for eligible children or grandchildren.

- Modified Plan:

- Death Benefit:

- Accidental Death: Full benefit payable immediately.

- Non-Accidental Death: Limited benefit in the first two policy years; full benefit thereafter.

- Benefit Amounts:

- Ages 45-75: $2,000 to $25,000

- Death Benefit:

Key Features

- No Medical Exam Required: Eligibility is determined through a health questionnaire, simplifying the application process.

- Lifetime Coverage: As long as premiums are paid, coverage remains in force for the insured’s lifetime.

- Cash Value Accumulation: Policies build cash value over time, which can be borrowed against if needed.

- Flexible Payment Options: Premium payments can be aligned with Social Security deposit schedules for convenience.

Aflac’s Final Expense Insurance is available for individuals aged 45 to 80, with benefit amounts tailored to the applicant’s age and health status. This coverage aims to alleviate the financial burden on loved ones by addressing expenses associated with end-of-life arrangements.

Sample Computation

The table below provides an overview of Aflac’s Final Expense Insurance monthly premiums based on age, gender, and a coverage amount of $10,000. These figures are illustrative and designed to help individuals understand potential costs for their specific circumstances.

Age | Gender | Coverage Amount | Monthly Premium |

50 | Female | $10,000 | $25.00 |

50 | Male | $10,000 | $30.00 |

60 | Female | $10,000 | $35.00 |

60 | Male | $10,000 | $42.00 |

70 | Female | $10,000 | $55.00 |

70 | Male | $10,000 | $65.00 |

80 | Female | $10,000 | $90.00 |

80 | Male | $10,000 | $110.00 |

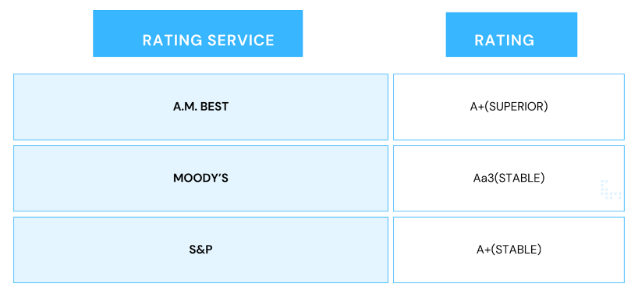

Financial Ratings

Aflac’s strong financial foundation is reflected in its high ratings:

These ratings signify Aflac’s ability to meet its financial obligations and its commitment to ethical business practices.

SOURCE:

https://news.ambest.com/PR/PressContent.aspx?refnum=33600&altsrc=9

Customer Reviews

Customer feedback highlights Aflac’s prompt claim processing and excellent customer service.

PROS AND CONS

CUSTOMER REVIEWS

PROS

Affordable premiums for most budgets

Quick and simple application process

No medical exam required

Reliable customer service and claims processing

Offers peace of mind for end-of-life expenses

CONS

Coverage limits may be lower than competitors

Not all applicants may qualify due to health

Limited Customization options for some plans

May not cover all final expense in high-cost areas

Available coverage options may vary by state

What Sets Aflac Apart?

Aflac (American Family Life Assurance Company) is well-known for its supplemental insurance offerings. Here’s what sets Aflac apart:

1. Supplemental Insurance Specialist

- Aflac focuses on supplemental insurance, which provides financial protection in the form of cash benefits to help cover out-of-pocket expenses not covered by traditional health insurance.

2. Cash Benefits Directly to Policyholders

- Unlike traditional insurance companies that pay healthcare providers, Aflac pays cash directly to policyholders. This allows individuals to use the money as they see fit, whether it’s for medical bills, rent, groceries, or other personal expenses.

3. No Network Restrictions

- Aflac policies are independent of healthcare networks. Policyholders can visit any doctor, specialist, or hospital of their choice without worrying about in-network restrictions.

4. Quick Claim Processing

- Aflac is renowned for its fast claims process. Many claims can be processed in as little as one day with the “One Day Pay” initiative, assuming all required documentation is provided.

5. Wide Range of Coverage Options

- Policies include accident, critical illness, cancer, hospital indemnity, dental, vision, and short-term disability coverage, catering to diverse needs.

6. Portable Policies

- Aflac policies are portable, meaning employees can retain their coverage even if they change jobs or become self-employed.

7. Family Coverage Options

- Aflac allows for the addition of family members to policies, making it convenient to ensure loved ones are also protected.

8. Educational and Enrollment Support

- Aflac provides extensive support during the enrollment process, including educational materials and online tools to help individuals understand their coverage options.

9. Strong Brand Recognition

- The iconic Aflac Duck and creative advertising campaigns have made Aflac a household name, giving the company strong brand credibility.

10. Corporate Social Responsibility

- Aflac is committed to philanthropy, particularly in the area of pediatric cancer research, showcasing its dedication to making a positive impact beyond insurance services.

Aflac’s emphasis on flexibility, customer-centric service, and innovative claim solutions makes it a standout in the supplemental insurance market.

Who is Aflac Final Expense Insurance For?

Aflac Final Expense Insurance is designed for individuals who want to ensure that their loved ones are financially protected against the costs associated with end-of-life expenses. This type of insurance is typically tailored for:

1. Seniors

- Age Group: Aflac’s final expense policies are usually targeted at individuals aged 50–85, though the exact age range may vary.

- Purpose: Seniors looking for a simple, affordable policy to cover funeral, burial, or other final expenses.

2. Individuals with Modest Insurance Needs

- Coverage Amounts: Policies typically offer smaller death benefits (e.g., $5,000 to $50,000) compared to traditional life insurance.

- Purpose: People who only need enough coverage to cover specific costs, such as funeral services, medical bills, or outstanding debts.

3. Those Who Want Easy Qualification

- No Medical Exams: Aflac final expense insurance usually does not require a medical exam, making it accessible to those with pre-existing health conditions.

- Simplified Issue: Applicants answer a few health-related questions, making it a good option for individuals who might not qualify for traditional life insurance.

4. Families Planning Ahead

- Peace of Mind: This insurance is for individuals who want to spare their families the financial burden of unexpected end-of-life costs.

5. People Seeking Permanent Coverage

- Lifetime Protection: Unlike term insurance, final expense insurance typically provides permanent coverage as long as premiums are paid.

Aflac Final Expense Insurance is ideal for anyone who wants to ensure that their loved ones are not burdened with financial worries during a difficult time, especially those looking for straightforward and manageable coverage.

How to Get Started?

- Getting started with Aflac Final Expense Insurance is simple: Research Your Options: Understand the different plans Aflac provides, such as Guaranteed Issue Whole Life Insurance and Level Benefit Whole Life Insurance. Each plan offers unique features and benefits to accommodate various financial goals and requirements.

- Determine which one suits your financial goals and needs.

- Contact us: You can also reach out to us at MuleFinal to discuss your needs, clarify plan details, and complete the application over the phone at 213.318.2130.

- Prepare Necessary Information: Have your personal details ready, including your age, health history, and any information about tobacco use. This will help streamline the application process.

- Complete the Application: Fill out the simplified application form. No medical exam is required, but you’ll need to answer a few health-related questions for certain plans.

- Review Your Policy: Once approved, carefully review your policy details to ensure they meet your expectations. If any adjustments are needed, discuss them with your agent.

- Start Your Coverage: Pay your first premium to activate your policy. Enjoy peace of mind knowing your loved ones are financially protected.

- For more information or to begin the process, contact MuleFinal, your trusted final expense broker.

How Does It Compare to Other Providers?

Aflac is well-known for its supplemental insurance offerings, but it also provides final expense insurance to help cover end-of-life costs. Comparing Aflac to other providers involves evaluating several key factors: cost, benefits, policy features, flexibility, and reputation. Here’s a breakdown:

1. Coverage Amount

- Aflac: Offers smaller coverage amounts, typically ranging from $5,000 to $50,000, designed to cover funeral expenses, medical bills, or other final costs.

- Competitors: Other providers, like Mutual of Omaha or Lincoln Heritage, may offer similar or higher coverage limits, often reaching up to $100,000.

2. Premium Costs

- Aflac: Premiums are generally competitive but may be slightly higher due to its brand reputation and ease of use.

- Competitors: Companies like Colonial Penn or Globe Life often offer lower initial premiums but may include graded death benefits or limited payout terms in the early years.

3. Underwriting Process

- Aflac: Often requires simplified underwriting, meaning no medical exam but health-related questions.

- Quick approval process.

- Competitors: Similar options are available, though some providers, like AIG, focus on guaranteed issue policies, which have no health questions but higher premiums.

4. Additional Benefits

- Aflac: Offers flexibility, including:

- Cash benefit payments that can be used for any purpose.

- Living benefits in some plans for terminal illnesses.

- Competitors: Other providers, such as Transamerica or Gerber Life, may include riders for accidental death, terminal illness, or chronic illness benefits.

5. Age Eligibility

- Aflac: Coverage is generally available to individuals aged 45 to 85, depending on the state.

- Competitors: Some companies, like Foresters Financial or AIG, extend eligibility to a broader range or lower the minimum age for entry.

6. Claims Process

- Aflac: Known for a quick claims process and direct payments to beneficiaries.

- Competitors: Many top providers offer fast processing times, though Aflac’s reputation for excellent customer service stands out.

7. Brand Reputation

- Aflac: A trusted name with a strong financial rating and history of customer satisfaction.

- Competitors: Mutual of Omaha, for example, also has an excellent reputation, while newer or smaller companies may have less-established track records.

Who Might Choose Aflac?

- Individuals looking for straightforward coverage with a trusted provider.

- Those who value customer service and a streamlined application process.

Who Might Look Elsewhere?

- People needing higher coverage amounts or specialized riders.

- Budget-conscious buyers comparing premium costs across several providers.

Aflac provides reliable final expense insurance, but the best provider depends on individual needs. It’s wise to compare quotes and consider specific features, like underwriting requirements, policy flexibility, and customer reviews, to find the policy that best fits your situation.

FINAL THOUGHTS

Aflac’s Final Expense Insurance provides a reliable and affordable solution for individuals looking to protect their families from the financial burden of end-of-life expenses. With a strong financial standing, competitive rates, and a customer-centric approach, Aflac remains a top choice for final expense coverage. If you’re seeking peace of mind and financial security, Aflac is a provider worth considering.

For more information or to get started, contact MuleFinal, your trusted final expense broker, today.

SOURCES

AFLAC

AM BEST

https://news.ambest.com/PR/PressContent.aspx?refnum=33600&altsrc=9

BBB (Better Business Bureau)

https://www.bbb.org/us/ga/columbus/profile/insurance-companies/aflac-0743-101327

Financial Ratings

https://investors.aflac.com/ratings/default.aspx

Type of Final Expense Plan

https://www.aflac.com/individuals/products/final-expense-whole-life-insurance.aspx?utm_source