TRANSAMERICA RIVIEW

Overview of Transamerica

Transamerica is a well-established American financial services company that has been serving customers for over a century. Founded in 1904 by A.P. Giannini, the company was originally set up as a holding company for the Bank of Italy, which eventually became Bank of America. Over time, Transamerica expanded its operations and became a leading provider of life insurance, retirement solutions, and investment products, offering innovative financial services designed to help individuals achieve long-term financial success.

Transamerica is widely known for its wide range of financial products and services, including life insurance, annuities, retirement planning, asset management, and more. The company has always maintained a focus on helping people take control of their financial futures with accessible and reliable solutions.

The company has built a strong reputation for customer-centric financial solutions and has a vast network of advisors who provide expert guidance to clients across the United States.

Headquarters: Transamerica’s headquarters is located at: 600 Montgomery Street,

San Francisco, California 94111,

United States

Official Website: www.transamerica.com

Goals and Values of Transamerica

At Transamerica, the core focus is to help individuals and families achieve financial security and peace of mind. The company’s goals revolve around providing innovative financial products and services that meet the diverse needs of its clients. Transamerica is committed to empowering customers with the tools and knowledge necessary to make informed decisions about their financial futures.

Goals:

- Customer-Centered Innovation: Transamerica continually seeks to develop new, forward-thinking products and services that are responsive to the evolving needs of their customers.

- Financial Empowerment: Helping individuals, families, and businesses plan for a secure financial future through accessible and comprehensive solutions.

- Long-Term Stability: Maintaining a strong, reliable foundation to deliver value and protect the financial well-being of customers over the long term.

- Sustainability: Ensuring that all business practices are environmentally and socially responsible, contributing to the well-being of future generations.

Core Values:

- Integrity: Transamerica holds itself to the highest standards of ethical conduct, making decisions that are transparent and fair to clients, partners, and employees.

- Accountability: The company takes responsibility for its actions and the outcomes of the financial solutions it provides, ensuring clients can trust in its expertise.

- Respect: Transamerica values diversity and aims to create a culture of respect, where every individual’s voice is heard and valued.

- Collaboration: Working together with clients, colleagues, and partners to achieve shared goals and maximize success.

- Excellence: Striving for continuous improvement in everything the company does, from customer service to financial products.

These guiding principles are at the heart of everything Transamerica does, ensuring that the company remains a trusted leader in the financial services industry.

Plans and Services Offered

Transamerica offers a range of final expense life insurance policies designed to provide financial support for end-of-life expenses, such as funeral costs and medical bills. These policies typically feature level premiums and guaranteed death benefits.

Transamerica’s Final Expense Life Insurance Plans:

- Transamerica FE Express Solution:

- Coverage Amount: $5,000 to $50,000.

- Features:

- Streamlined digital application process with approval in as little as 10 minutes.

- No medical exams required.

- Optional Concierge Planning Rider at no additional cost, offering assistance with funeral planning, legal documents, and estate planning.

- Policy Delivery: Digital policy delivery within minutes.

- Transamerica Final Expense Immediate Solution:

- Coverage Amount: $1,000 to $50,000.

- Ages: 0–85.

- Features:

- Digital or paper applications available.

- Real-time underwriting decisions in most cases.

- Optional riders, including Accelerated Death Benefit Rider and Children’s and Grandchildren’s Benefit Rider.

- Policy Delivery: Digitally enabled underwriting with real-time decisions.

- Transamerica Final Expense 10-Pay Solution:

- Coverage Amount: $1,000 to $50,000.

- Features:

- Level premiums for 10 years, after which no further premiums are required.

- Permanent coverage with a guaranteed death benefit.

- Optional riders, such as Accelerated Death Benefit Rider and Children’s and Grandchildren’s Benefit Rider.

- Policy Delivery: Digitally enabled underwriting with real-time decisions.

- Transamerica Final Expense Easy Solution:

- Coverage Amount: $1,000 to $50,000.

- Features:

- Simplified application process with no medical exams.

- Permanent coverage with a guaranteed death benefit.

- Optional riders, including Accelerated Death Benefit Rider and Children’s and Grandchildren’s Benefit Rider.

- Policy Delivery: Digitally enabled underwriting with real-time decisions.

Key Features Across Transamerica’s Final Expense Policies:

- No Medical Exams: Most policies do not require medical exams, simplifying the application process.

- Guaranteed Death Benefit: As long as premiums are paid, beneficiaries receive a guaranteed death benefit.

- Level Premiums: Premiums remain consistent throughout the life of the policy.

- Optional Riders: Additional coverage options, such as the Concierge Planning Rider, are available to enhance the policy.

Please note that policy availability and features may vary by state. We recommend consulting with us first to determine the best option for your specific needs. Contact us at 213.318.2130.

Key Features

Transamerica’s final expense insurance boasts several features that make it a reliable choice:

- Affordable Premiums

Premiums for final expense policies are typically low and can fit a variety of budgets. These premiums are fixed, ensuring they won’t increase as you age. - No Medical Exam Required

Transamerica’s final expense policies don’t require a medical exam, and approval is often based on answers to a few health-related questions. This makes it accessible for those with less-than-perfect health. - Coverage for Funeral Costs

The primary purpose of final expense insurance is to cover funeral and burial expenses, but it can also be used to pay for outstanding medical bills, credit card debt, or other final expenses. - Coverage for Funeral Costs

The primary purpose of final expense insurance is to cover funeral and burial expenses, but it can also be used to pay for outstanding medical bills, credit card debt, or other final expenses. - Guaranteed Acceptance

With the guaranteed issue plan, no health questions are asked, and coverage is guaranteed for those who qualify within the age range.

Sample Computation

Here’s a sample computation table for Transamerica final expense insurance based on gender, age, monthly rate, coverage amount, and plan type.

Plan Type | Age | Coverage Amount | Monthly Premium Estimate | Additional Notes |

Immediate Solution | 50 | $10,000 | $50–$60 | Level premiums to age 121, face amounts up to $50,000. |

65 | $10,000 | $70–$85 | ||

10-Pay Solution | 50 | $10,000 | $100–$120 | Level premiums for 10 years, face amounts up to $50,000. |

65 | $10,000 | $130–$150 | ||

Easy Solution | 50 | $10,000 | $60–$70 | Level premiums to age 121, face amounts up to $25,000. |

65 | $10,000 | $80–$100 |

Premiums will vary depending on age, health, and the selected coverage amount. It’s important to get a personalized quote. Contact us at 213-318-2130.

Financial Ratings

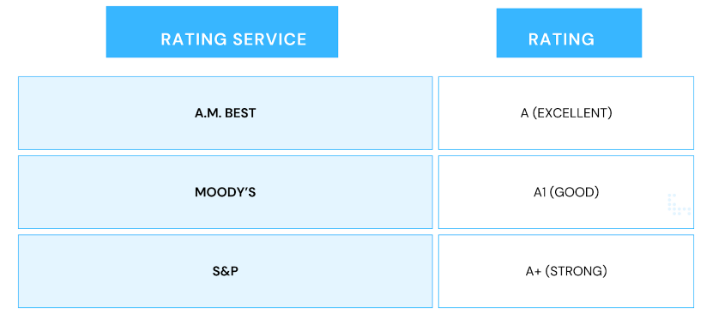

Transamerica holds solid financial ratings from several reputable agencies, reflecting its stability and reliability in the insurance market:

These ratings signify that Transamerica is in good financial standing, which ensures that policyholders can trust the company to honor claims and provide long-term support.

Source: https://www.transamerica.com/about-us/financial-strength

FORBES

Transamerica was honored by Forbes as one of America’s Best Insurance Companies.

This recognition underscores Transamerica’s dedication to delivering innovative, customer-centric solutions that empower individuals to plan for a secure future. The award highlights the company’s achievements in providing quality services, maintaining strong client relationships, and fostering sustainable growth. This accolade not only enhances Transamerica’s reputation but also reinforces its commitment to excellence and its continued contributions to the financial sector.

Source: https://www.transamerica.com/news/forbes-ranks-transamerica-among-top-insurance-companies-2024

Customer Reviews

Customer feedback about Transamerica’s final expense insurance is generally positive. Many customers appreciate the ease of getting coverage and the affordable premiums. Here are some of the common points mentioned in reviews:

PROS AND CONS

CUSTOMER REVIEWS

PROS

No medical exams are needed to apply.

Premiums stay the same forever.

Strong financial rating (A from A.M.Best)

Offers benefits for serious illnesses

CONS

Some delays in getting the policy.

Customer service can be slow.

Not available in all states.

Graded and Return of Premium Plans: These plans have limited benefits during the initial years, which may be a drawback for some applicants.

It’s always recommended to read up-to-date customer reviews.

What Sets Transamerica Apart?

Transamerica stands out in the financial services industry for several key reasons:

- Comprehensive Financial Solutions: Transamerica offers a wide range of services, including life insurance, retirement planning, investment management, and financial advisory services. This allows customers to address multiple aspects of their financial needs in one place.

- Legacy and Trust: With over 100 years of experience, Transamerica has built a strong reputation for financial stability and trustworthiness. The company’s long-standing history has established it as a reliable partner in helping individuals and families plan for their financial futures.

- Customer-Focused Approach: Transamerica is known for providing personalized financial planning and customer service. Their approach emphasizes understanding each customer’s unique needs and goals, allowing for tailored solutions.

- Retirement Focus: One of the company’s distinguishing features is its strong emphasis on retirement planning. With various retirement savings plans like 401(k)s, IRAs, and annuities, Transamerica supports individuals in building and securing their future income.

- Innovative Digital Tools: Transamerica offers modern digital tools that help clients manage their accounts, track their financial goals, and make informed decisions. This blend of technology with financial expertise provides added convenience and accessibility.

- Sustainability and Social Responsibility: Transamerica is committed to sustainability and responsible investing. The company integrates environmental, social, and governance (ESG) factors into its investment strategies, appealing to customers who prioritize ethical investments.

Overall, Transamerica’s combination of experience, broad financial services, and forward-thinking approach sets it apart from competitors in the financial services industry.

Who is Transamerica Final Expense Insurance For?

Transamerica’s final expense insurance is ideal for:

- Older Adults: Individuals aged 50 to 85 looking for affordable coverage to cover end-of-life costs.

- Those Without Life Insurance: Those who do not have life insurance and need a simpler solution for funeral expenses.

- People With Health Concerns: Those who may not qualify for traditional life insurance due to medical conditions.

Budget-Conscious Individuals: Those looking for a budget-friendly way to cover funeral and burial expenses without the complexity of traditional life insurance.

How to Get Started?

Getting started with Transamerica Final Expense Insurance is simple:

- Research Your Options: Understand the different plans that Transamerica provides. Each plan offers unique features and benefits to accommodate various financial goals and requirements.

- Determine which one suits your financial goals and needs.

- Contact us: You can also reach out to us at MuleFinal to discuss your needs, clarify plan details, and complete the application over the phone at 213.318.2130.

- Prepare Necessary Information: Have your personal details ready, including your age, health history, and any information about tobacco use. This will help streamline the application process.

- Complete the Application: Fill out the simplified application form. No medical exam is required, but you’ll need to answer a few health-related questions for certain plans.

- Review Your Policy: Once approved, carefully review your policy details to ensure they meet your expectations. If any adjustments are needed, discuss them with your agent.

- Start Your Coverage: Pay your first premium to activate your policy. Enjoy peace of mind knowing your loved ones are financially protected.

For more information or to begin the process, contact MuleFinal, your trusted final expense broker.

How Does It Compare to Other Providers?

When compared to other final expense providers, Transamerica offers competitive rates and a variety of options. Other companies may offer similar no-medical exam policies, but Transamerica’s financial stability, flexible plans, and customer service make it a solid contender. For individuals interested in burial insurance, Transamerica’s offerings are highly rated for their simplicity and accessibility.

Provider | Coverage Amount | Eligibility | Underwriting | Pros | Cons |

Transamerica | $1,000 to $50,000 | Ages 50-85 | Simplified issue, health questions | Flexible coverage options, strong reputation, competitive pricing | Higher premiums for those with health issues |

AIG | $5,000 to $25,000 | Ages 50-85 | Simplified issue, health questions | Long-standing reputation, affordable options | Higher premiums for pre-existing conditions, lower coverage limits |

Colonial Penn | $1,000 to $50,000 | Ages 50-85 | Guaranteed acceptance (no medical questions), waiting period | Easy application process, guaranteed acceptance | Higher premiums, waiting period for full coverage benefits |

Mutual of Omaha | $2,000 to $40,000 | Ages 45-85 | Simplified and guaranteed issue policies | Strong customer service, flexible policy options, good value for coverage | Higher premiums for guaranteed issue, waiting period for full coverage |

Foresters Financial | Up to $35,000 | Ages 50-85 | Simplified and guaranteed issue policies | Competitive rates for healthy individuals, good customer service | Expensive guaranteed issue, waiting period for full coverage |

This table provides a quick side-by-side comparison of the key details for each provider, helping you make an informed decision about which final expense insurance may be the best fit for your needs.

FINAL THOUGHTS

Transamerica’s final expense insurance is an excellent choice for individuals looking to cover the costs associated with their passing, without placing an additional financial burden on their loved ones. With easy-to-understand coverage, no medical exam options, and affordable premiums, Transamerica provides a secure and reliable option for those in their later years. Before purchasing any insurance policy, it’s important to compare providers and ensure the plan meets your specific needs.

SOURCE

Transamerica

Plans and Services

https://www.transamerica.com/financial-pro/insurance/final-expense-life-insurance?utm

Financial Ratings

https://www.transamerica.com/about-us/financial-strength

Forbes

https://www.transamerica.com/news/forbes-ranks-transamerica-among-top-insurance-companies-2024