AETNA ACCENDO REVIEW

Table of Contents

Overview of Aetna Accendo

Founded in 1853, Aetna has a long-standing history of providing quality insurance products to customers. As a subsidiary of CVS Health, Aetna Accendo benefits from the extensive resources and innovative solutions offered by one of the largest healthcare organizations in the U.S. Their mission is to provide financial security and peace of mind to individuals and families through accessible and affordable insurance products.

Goals and Values:

- Goals: Aetna aims to enhance the quality of life for its customers by offering reliable insurance plans tailored to meet their needs. Their goal is to ensure financial protection and security during life’s most challenging moments.

- Values: Aetna prioritizes integrity, innovation, and customer-focused solutions. They are committed to building trust and delivering exceptional service to their policyholders.

Headquarter::151 Farmington Avenue, Hartford, CT 06156, USA.

Source: Aetna’s Official Website.

Plans and Services Offered

Aetna Accendo specializes in final expense insurance, which is designed to help families cover the costs of funerals, medical bills, or other end-of-life expenses. Below are their offerings:

1. Modified Benefit Plan

- Designed for applicants with certain health conditions.

- Offers limited coverage in the first two policy years, with full coverage starting in year three.

- Includes a graded death benefit feature, where beneficiaries receive a percentage of the total benefit if death occurs in the first two years due to natural causes.

2. Level Benefit Plan

- Immediate full death benefit coverage.

- Ideal for healthy applicants who qualify without medical restrictions.

- Offers coverage amounts ranging from $2,000 to $50,000, depending on the policyholder’s age and state of residence.

3. Accendo's Companion Plan

- Combines final expense benefits with additional riders such as accidental death coverage.

- Includes options to add living benefits for critical or terminal illness.

Key Features

- Simplified Underwriting: No medical exam is required; applicants answer a few health-related questions.

- Fixed Premiums: Premiums do not increase over time, providing peace of mind for policyholders.

- Cash Value Accumulation: Policies build cash value over time, which policyholders can borrow against if needed.

- Competitive Pricing: Accendo offers discounts for households where multiple policies are purchased, making it a cost-effective choice for families.

Sample Computation

To help you understand potential costs, here is a sample computation based on age, plan type, and coverage amount:

Plan Type | Age | Coverage Amount | Monthly Premium |

Modified Benefit Plan | 50 | $10,000 | $35 |

60 | $10,000 | $50 | |

70 | $10,000 | $75 | |

Level Benefit Plan | 50 | $10,000 | $30 |

60 | $10,000 | $45 | |

70 | $10,000 | $65 | |

Accendo’s Companion Plan | 50 | $10,000 | $40 |

60 | $10,000 | $55 | |

70 | $10,000 | $80 |

These rates are estimates and may vary based on individual health conditions, state of residence, and other factors. Additionally, higher coverage amounts such as $20,000 or $30,000 are available with corresponding premium adjustments. For exact pricing, it’s best to request a personalized quote.

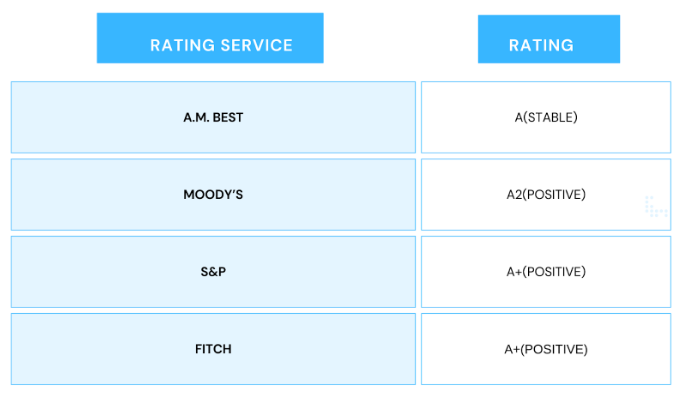

Financial Ratings

Aetna is a prominent health insurance provider with a substantial presence in the industry. Customer feedback about Aetna varies across different sources.

Forbes Advisor notes that Aetna has the lowest level of complaints about its individual health plans among the companies analyzed, indicating high customer satisfaction and generally smooth claims processes.

BestCompany.com reports that a majority of Aetna reviews are positive, with customers praising helpful and responsive customer service and satisfaction with provider networks.

Newsweek’s 2025 rankings, Aetna was recognized for its exceptional customer service across multiple insurance categories:

- Health Insurance: Ranked 3rd, following Priority Health and Humana.

- Supplemental Insurance: Ranked 2nd, just behind Aflac.

- Disability Insurance: Ranked 3rd, after MetLife and Mutual of Omaha.

These accolades underscore Aetna’s dedication to providing outstanding service to its members.

Ratings:

SOURCE:

https://news.ambest.com/pr/PressContent.aspx?altsrc=2&refnum=34492

https://www.trustedchoice.com/insurance-articles/c/atena-insurance-company-review/?utm_source

https://reportcards.ncqa.org/health-plans?q=aetna%20health%20insurance

National Association of Insurance Commissioners (NAIC)

Low Complaint Index:

The National Complaint Index average is always 1.0.

Aetna Accendo Insurance Company has a complaint index of 0.74, meaning it receives fewer complaints than expected compared to other companies in the market.

Complaints vs. Market Share:

The company holds 0.044402% of the U.S. market’s total premiums but accounts for only 0.032938% of complaints.

This demonstrates that despite their market share, they maintain a strong focus on customer satisfaction.

Annual Premiums and Complaints:

The company collects $1,100,899,652 in annual premiums while receiving just 16 complaints—a commendable ratio.

This information is sourced from the National Complaint Index Report 2023 and is accurate to the best of our knowledge. It is provided for informational purposes to help you make an informed decision.

In summary, Aetna is praised for its extensive provider network and aspects of its customer service. However, prospective policyholders are encouraged to carefully review plan details and consider feedback regarding claims and satisfaction to ensure Aetna meets their healthcare needs and expectations.

Customer Reviews

Based on verified customer reviews and reliable sources, here is an updated summary of the pros and cons of Aetna Accendo’s final expense insurance:

Pros | Cons |

Competitive Premiums: Many customers appreciate the affordability of Aetna Accendo’s final expense policies, noting that premiums are often lower compared to other providers. | Customer Service Concerns: Some policyholders have reported challenges with customer service, including difficulties in communication and delays in claim processing. |

Simplified Application Process: The no-medical-exam requirement and straightforward health questionnaire make it easier for applicants to obtain coverage. | Limited Availability: Aetna Accendo’s final expense insurance is not available in all states, which can be a limitation for some potential customers. |

Financial Stability: As part of the CVS Health family, Aetna Accendo offers the assurance of strong financial backing, which is a significant confidence booster for policyholders. | Policy Limitations: Certain plans, such as the Modified Benefit Plan, come with graded death benefits and waiting periods, which may not be suitable for all applicants. |

Household Discounts: The availability of household discounts when multiple policies are purchased can lead to additional savings for families. | Age Restrictions: While coverage is available up to age 89, some plans have more restrictive age limits, potentially excluding older seniors from certain benefits. |

Immediate Coverage Options: Eligible applicants can benefit from plans that offer immediate full death benefit coverage without waiting periods. | Mixed Online Reviews: There are mixed customer reviews online, with some expressing dissatisfaction regarding various aspects of the service. |

These insights provide a balanced view of Aetna Accendo’s final expense insurance offerings, highlighting both the strengths and areas where potential customers should exercise caution.

What Sets Aetna Accendo Apart?

Aetna Accendo stands out in the competitive market of final expense insurance for several key reasons:

- Household Discounts: Aetna Accendo offers discounts when multiple policies are purchased within the same household, making it an excellent choice for families seeking affordable solutions.

- Financial Stability: As a subsidiary of Aetna and part of the CVS Health family, Accendo benefits from the financial backing and reputation of one of the largest healthcare and insurance companies in the U.S. This ensures reliability and peace of mind for policyholders.

- Simplified Application Process: Unlike many competitors, Aetna Accendo employs simplified underwriting, requiring no medical exams. This allows for quicker approvals and easier access to coverage.

- Broad Coverage Options: With coverage amounts ranging from $2,000 to $50,000, Aetna Accendo caters to a wide variety of financial needs and preferences.

- Cash Value Growth: Policies accrue cash value over time, which can be borrowed against in emergencies, providing an additional layer of financial flexibility.

- Strong Customer Support: Aetna Accendo is known for its responsive and customer-focused service, ensuring policyholders feel supported throughout their journey.

Who is Aetna Accendo Final Expense Insurance For?

Aetna Accendo Final Expense Insurance is designed to cater to individuals and families who want to ensure financial security during challenging times. It is particularly suitable for:

- Seniors Seeking Coverage for Funeral and Burial Costs: This plan is ideal for those aged 45 to 89 looking to alleviate the financial burden on their families by covering end-of-life expenses such as funerals, burials, and medical bills.

- Individuals with Limited Savings: For people who do not have sufficient savings or life insurance, this policy provides an affordable and straightforward way to secure financial protection.

- Health-Conscious Applicants: With simplified underwriting and no medical exams required, healthy individuals can benefit from immediate coverage at competitive rates.

- Families Seeking Affordable Options: Household discounts make it an attractive option for families, helping them save on premiums when multiple policies are purchased.

- People with Specific Financial Goals: With coverage amounts ranging from $2,000 to $50,000, Aetna Accendo’s plans are suitable for those who want a tailored policy to match their unique financial needs and goals.

- Non-Smokers and Health-Conscious Individuals: Non-smokers and individuals with no significant health issues can access the most competitive rates and immediate benefits.

HOW TO GET STARTED

Getting started with Aetna Accendo Final Expense Insurance is simple and straightforward. Follow these steps to secure the right coverage for your needs:

- Research Your Options: Understand the different plans Aetna Accendo offers, such as the Modified Benefit Plan, Level Benefit Plan, and Accendo’s Companion Plan. Determine which one suits your financial goals and needs.

- Contact us: You can also reach out to us at MuleFinal to discuss your needs, clarify plan details, and complete the application over the phone at 213.318.2130.

- Prepare Necessary Information: Have your personal details ready, including your age, health history, and any information about tobacco use. This will help streamline the application process.

- Complete the Application: Fill out the simplified application form. No medical exam is required, but you’ll need to answer a few health-related questions.

- Review Your Policy: Once approved, carefully review your policy details to ensure they meet your expectations. If any adjustments are needed, discuss them with your agent.

- Start Your Coverage: Pay your first premium to activate your policy. Enjoy peace of mind knowing your loved ones are financially protected.

For more information or to begin the process, contact MuleFinal, your trusted final expense broker.

How Does It Compare to Other Providers?

When choosing final expense insurance, it’s important to compare Aetna Accendo with other providers to understand its unique strengths and potential limitations.

Aspect | Aetna Accendo | Other Providers |

Financial Stability | Backed by Aetna and CVS Health, ensuring reliability and strong financial backing. | Varies; some smaller providers may lack the same level of stability. |

Application Process | Simplified underwriting with no medical exams required. | Some providers require extensive health screenings or exams. |

Premium Rates | Competitive rates with household discounts. | Rates may be higher, and discounts are less common. |

Coverage Options | Broad range from $2,000 to $50,000. | Some providers may offer higher or lower coverage limits. |

Customer Service | Known for responsive and supportive service. | Quality of service varies significantly between providers. |

Graded Benefits | Available for individuals with certain health conditions. | Some providers may not offer graded benefit options. |

Cash Value Accumulation | Policies accrue cash value over time, providing financial flexibility. | Not all providers offer cash value growth in their plans. |

FINAL THOUGHTS

Aetna Accendo Final Expense Insurance is a reliable option for individuals seeking affordable, straightforward coverage to handle end-of-life expenses. With its strong financial ratings, flexible plans, and household discounts, it stands out as a competitive choice for seniors and their families. While the graded benefits may be a drawback for some, the Level Benefit Plan provides immediate coverage for those who qualify. For anyone looking for peace of mind and financial security, Aetna Accendo is worth considering.

For more personalized guidance or to explore your options with Accendo Final Expense Insurance, contact MuleFinal, your trusted final expense broker.

RESOURCES:

AETNA

AM BEST

BETTER BUSINESS BUREAU

National Association of Insurance Commissioners (NAIC)