MUTUAL OF OMAHA REVIEW

Table of Contents

- Mutual of Omaha Story

- Mutual of Omaha’s Living Promise Final Expense Insurance

- Premium Rates and Factors

- Financial Ratings

- Customer Reviews

- What Sets Mutual of Omaha Apart: Key Considerations Before Choosing

- Who is Mutual of Omaha Final Expense Insurance For?

- How to Get Started

- How Does It Compare to Other Providers?

- Final Thoughts

Final expense insurance, often called burial or funeral insurance, is designed to cover the costs associated with end-of-life expenses. Mutual of Omaha, a well-known name in the insurance industry, offers a reliable and affordable final expense insurance option. This review dives into the details of their product, helping you decide if it’s the right fit for your needs.

MUTUAL OF OMAHA

Founded in 1909 by Dr. C.C. and Mabel Criss, Mutual of Omaha is a well-established insurance and financial services company headquartered in Omaha, Nebraska. Known for its stability and customer-first philosophy, the company provides products and services to help individuals and families achieve financial security and peace of mind.

- Mission & Values: Guided by integrity, compassion, and innovation, Mutual of Omaha aims to protect what matters most to its customers.

- Comprehensive Offerings: Products include life insurance, Medicare supplements, disability insurance, and long-term care insurance.

- Customer-Centric Approach: Focused on simplifying processes and delivering personalized service.

Headquarters: 3300 Mutual of Omaha Plaza, Omaha, Nebraska, USA

Source: Mutual of Omaha Official Website

With over a century of expertise, Mutual of Omaha remains a trusted partner in financial protection and planning.

Mutual of Omaha’s Living Promise Final Expense Insurance

Mutual of Omaha offers final expense insurance through their Living Promise Whole Life Insurance plans, designed to cover end-of-life expenses such as funerals and medical bills. These policies are available to individuals aged 45 to 85, with coverage amounts ranging from $2,000 to $50,000.

1. Level Benefit Plan

- Immediate Full Coverage: The full death benefit is payable from the first day of the policy.

- Eligibility: Requires health questions but no medical exam.

- Fixed Premiums: Premiums remain level for the life of the policy.

- Cash Value: Builds over time and can be accessed if needed.

2. Graded Benefit Plan

- Two-Year Waiting Period: During the first two years, natural death results in a payout of premiums paid plus 10% interest. Full coverage begins after the two-year period.

- No Medical Exam: Health questions are required for eligibility.

- Ideal for Individuals with Health Conditions: Designed for applicants with certain medical conditions.

3. Guaranteed Whole Life Insurance

- No Health Questions or Medical Exam: Acceptance is guaranteed for applicants aged 45 to 85.

- Coverage Up to $25,000: Offers smaller coverage amounts.

- Two-Year Waiting Period: During this period, beneficiaries receive premiums paid plus interest for natural deaths. Full coverage begins after two years.

- Fixed Premiums and Cash Value: Premiums remain level, and the policy builds cash value over time.

PREMIUM RATES AND FACTORS

Premiums for Mutual of Omaha’s Living Promise plans are determined by factors including age, gender, health status, tobacco use, and the selected coverage amount.

Note: These rates are approximate and may vary based on individual circumstances.

Age | Gender | Coverage Amounts | ||

$10,000 | $25,000 | $50,000 | ||

45 | Female | $23 | $56 | $112 |

45 | Male | $27 | $65 | $130 |

65 | Female | $45 | $113 | $225 |

65 | Male | $54 | $136 | $271 |

85 | Female | $164 | $410 | $820 |

85 | Male | $214 | $536 | $1,072 |

Highlights:

Female Premiums: Generally lower than male premiums due to actuarial factors.

Male Premiums: Higher due to slightly increased risk factors in mortality tables.

Notes:

Premium rates are for non-smokers and assume no significant health issues. Contact Us for personalized quotes and additional coverage options.

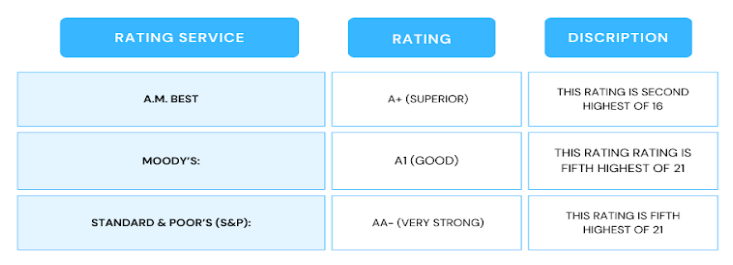

FINANCIAL RATINGS

Mutual of Omaha has consistently received strong financial ratings, reflecting its stability and ability to meet policyholder obligations:

SOURCE: https://www.mutualofomaha.com/about/financial-strength/ratings

https://news.ambest.com/newscontent.aspx?refnum=248191&altsrc=23

These ratings highlight Mutual of Omaha’s financial strength, making it a trustworthy provider for long-term insurance products.

Consumer Protection Organization

Better Business Bureau (BBB):

- Average Rating: 1.13 out of 5 stars

- Total Reviews: 92

- BBB Rating: A+

- Accreditation: BBB Accredited

- View BBB Reviews

National Association of Insurance Commissioners (NAIC)

Low Complaint Index:

- The National Complaint Index average is always 1.0.

- United of Omaha Life Insurance Company has a complaint index of 0.32, meaning it receives significantly fewer complaints than expected compared to other companies in the market.

Complaints vs. Market Share:

- The company holds 0.26% of the U.S. market’s total premiums but accounts for only 0.08% of complaints.

- This shows that despite their market share, they maintain a strong focus on customer satisfaction.

Annual Premiums and Complaints:

- The company collects $6,457,078,913 in annual premiums while receiving just 40 complaints—a commendable ratio.

This information is sourced from the National Complaint Index Report 2023 and is accurate to the best of our knowledge. It is provided for informational purposes to help you make an informed decision.

CUSTOMER REVIEWS

Mutual of Omaha consistently receives positive feedback from its customers. Here are the common themes found in reviews:

PROS AND CONS

CUSTOMER REVIEWS

PROS

No medical exam is needed, making it simple and fast to apply.

Guaranteed approval options are available, even for people with health issues.

Flexible coverage amounts let you choose a plan that fits your needs and budget.

Some plans offer extra benefits, like accessing part of the payout early for serious illnesses.

Policies build cash value over time, which you can borrow if needed.

CONS

Some policies limit the payout during the first two years unless the death is accidental.

Policies may not be available in all states, so availability could be an issue.

Coverage is only for people aged 50-85, leaving younger applicants without options.

Guaranteed approval plans may have higher premiums than other options.

Borrowing from the policy's cash value comes with interest and reduces the payout.

Customer reviews and ratings were analyzed from platforms such as the Better Business Bureau (BBB), and independent insurance review websites, reflecting a broad spectrum of user experiences. Mutual of Omaha is widely praised for its strong customer service and dependable policies.

Customer Satisfaction

Mutual of Omaha is recognized as one of the top-performing life insurance providers in customer satisfaction. In a recent J.D. Power U.S. Individual Life Insurance Study, the company ranked #6 for customer satisfaction, showcasing its dedication to providing a reliable and approachable service experience. This ranking highlights Mutual of Omaha’s continued commitment to meeting the needs of its policyholders.

Overall: Mutual of Omaha is widely regarded as a dependable and customer-focused carrier for final expense insurance.

What Sets Mutual of Omaha Apart?

1. Affordable and Predictable Costs

- Competitive pricing and fixed premiums.

2. Reputable Provider

- Over 100 years of experience in the insurance industry.

3. Flexible Payment Plans

- Payment options include monthly, quarterly, semi-annual, or annual schedules.

4. Living Benefits

- Riders like the accelerated death benefit allow policyholders to access part of the death benefit if diagnosed with a terminal illness.

Considerations Before Choosing Mutual of Omaha

1. Limited Death Benefit Amount

- Maximum coverage may not meet the needs of those seeking higher coverage.

2. Waiting Period for Certain Plans

- Graded and guaranteed plans have a two-year waiting period for full natural death benefits.

Who is Mutual of Omaha Final Expense Insurance For?

- Seniors looking for easy-to-qualify life insurance.

- Individuals wanting to cover funeral costs and small debts.

- Those seeking a no-exam insurance option with fixed premiums.

HOW TO GET STARTED

To get started with an application for Mutual of Omaha’s Final Expense Insurance, follow these steps:

- Assess Your Needs: Determine the coverage amount required to cover final expenses, such as funeral costs, medical bills, or other debts.

- Explore Your Options: Review the available Final Expense Insurance plans to explore coverage options, premiums, and plan benefits.

- Contact us: You can also reach out to us at MuleFinal to discuss your needs, clarify plan details, and complete the application over the phone at 213.318.2130.

- Choose a Plan: Select a plan that fits your budget and provides the coverage you need. Several plans offer fixed premiums and require no medical exams, making qualification simple.

- Complete the Application: Whether applying online or through an agent, you’ll need to provide basic information such as age, health history, and beneficiary details. Simplified underwriting is common, involving only a few health-related questions.

- Submit the Application: Once you’ve completed the application online or with a broker, it will be submitted for review.

- Approval and Policy Delivery: After approval, Mutual of Omaha will send your policy documents electronically or by mail. These will include the terms, coverage details, and payment instructions.

- Make Payments: Begin making premium payments according to the agreed schedule to activate and maintain your coverage.

HOW DOES MUTUAL OF OMAHA COMPARE TO OTHER SERVICE PROVIDER

Mutual of Omaha competes with providers such as:

- AIG: Offers guaranteed acceptance policies with no health questions.

- Gerber Life: Known for simplified application processes.

- Colonial Penn: Features flexible payment terms and guaranteed acceptance.

FINAL THOUGHTS

Mutual of Omaha’s Living Promise and Guaranteed Whole Life Insurance policies are excellent solutions for individuals seeking final expense coverage. With their affordable premiums, flexible options, and reliable service, they are a trusted choice for those preparing for end-of-life expenses.

Ensure you assess your financial needs and consult with an agent to select the best policy for your situation. Taking this step offers peace of mind and protects your loved ones during challenging times.

Disclaimer: This review is for informational purposes and not a substitute for professional financial or insurance advice. Always consult a licensed agent before making decisions.

RESOURCES:

J.D Power

https://www.jdpower.com/business/press-releases/2024-us-individual-life-insurance-study

MUTUAL OF OMAHA

https://www.mutualofomaha.com/life-insurance/whole-life-insurance

BETTER BUSINESS BUREAU

https://www.bbb.org/us/ne/omaha/profile/insurance-companies/mutual-of-omaha-0714-104000434

AM BEST

https://news.ambest.com/newscontent.aspx?refnum=248191&altsrc=23

National Association of Insurance Commissioners (NAIC)